Book value per share calculator

This method is very helpful for the investors to find whether the stock of the company is undervalued. It is calculated by the company as shareholders equity book value divided by the number of shares outstanding.

Fundamental Accounting Equation In 2022 Accounting Accounting Books Accounting And Finance

The term book value is a companys assets minus its liabilities and is sometimes referred to as stockholders equity owners equity shareholders equity or simply equity.

. Book value per share can be calculated using the formula below. Book value per share is a measure often used by investors to determine the level of safety associated with a stock investment. Book Value per share Total common shareholders equity Number of common shares Here is the workout.

In other words the company has 2000 equities each of which is valued at Rs100. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Calculate the Book value per Share of the international corporation.

Stock holders equity Preferred Stock Total outstanding shares. Book value per Share. International corporation has 2000000 of stockholders equity 500000 of preferred stock and total of 300000 shares outstanding during the measurement period.

Earnings Before Interest Taxes Depreciation and Amortization EBITDA Calculator. Example of Book Value per Common Share. Enter the following details into the calculator.

Stock holders equity 2000000 Preferred Stock 500000 Total outstanding. The price-to-book ratio PB Ratio is a ratio used to compare a stocks market value to its book value. Cash Earnings per Share CEPS Calculator.

Enter the value of preferred equity. Book Value Per Share Total owners equity Number of shares outstanding. Enter the number as per calculations explained above.

Formula Book Value Per Share Total common stockholders equity - Preferred stock Number of common shares Example ABC a company has the following information- Total assets at the end of the year 150000 Total liabilities at the end of the year 80000 Preferred Stock 20000 Number of common shares 2000 shares. The book value per share is the value each share would be worth if the company were to be liquidated all the bills paid and the assets distributed. The Book of Mormon was originally sold to the public for 135 million in 1999 but has since risen to 15 million making it.

This calculator will compute the book value per share for a companys common stock given the total shareholders equity the liquidation value of any preferred stock the amount of preferred dividends in arrears and the number of shares of common stock outstanding. Book Value Per Share Definition. It is calculated by the company as shareholders equity book value divided.

Degree of Operating Leverage DOL Calculator. Book Value Per Share Definition. First we need to find out shareholders equity which is the difference between Total Assets and Liabilities which is 5350085089 3568977062 1781108027.

The book value per share of common stock represents the right that each share. Formula The Book Value Per Share calculation formula is as follows. Book value per share 200000 2000 So the result here is 100 which means the company actually has the equity of value 100 each.

Book value per share also lets helps the common shareholder understand what they might claim. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Price-To-Book Ratio - PB Ratio.

In the below calculator enter total stockholders equity in US dollars enter the number of shares click calculate to find out the Book value per share. Therefore the calculation of book value per share is as follows BVPS Total Common shareholders equity Preferred Stock Number of outstanding common shares. Earnings Before Interest and Taxes EBIT Calculator.

Tangible book value per share TBVPS is the value of a companys tangible assets divided by its current outstanding shares. The Book Value Per Share Calculator is used to calculate the book value per share. The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders.

The number of total outstanding shares in the company to be entered here. It is calculated by dividing the current closing price of. Book Value per Common Share Calculation.

The book value per share of a company is easy to calculate and helps the investor determine whether a stock is currently undervalued or overvalued. TBVPS determines the potential value per share of a company in the event. How to use the calculator to measure your book value per common share.

The Book of Mormon actually has a market capitalization of over 32 billion which puts its share price at 215. The Book Value Per Share Calculator is used to calculate the book value per share.

How To Calculate Price To Sales Ratio In 2022 Fundamental Analysis Tricky Questions Stock Market Investing

The Book Value Per Share Formula Is Used To Calculate The Per Share Value Of A Company Based On Its Equity Available To Co Book Value Business Valuation Shared

Trading News Option Trading Stock Trading Strategies Stock Options Trading

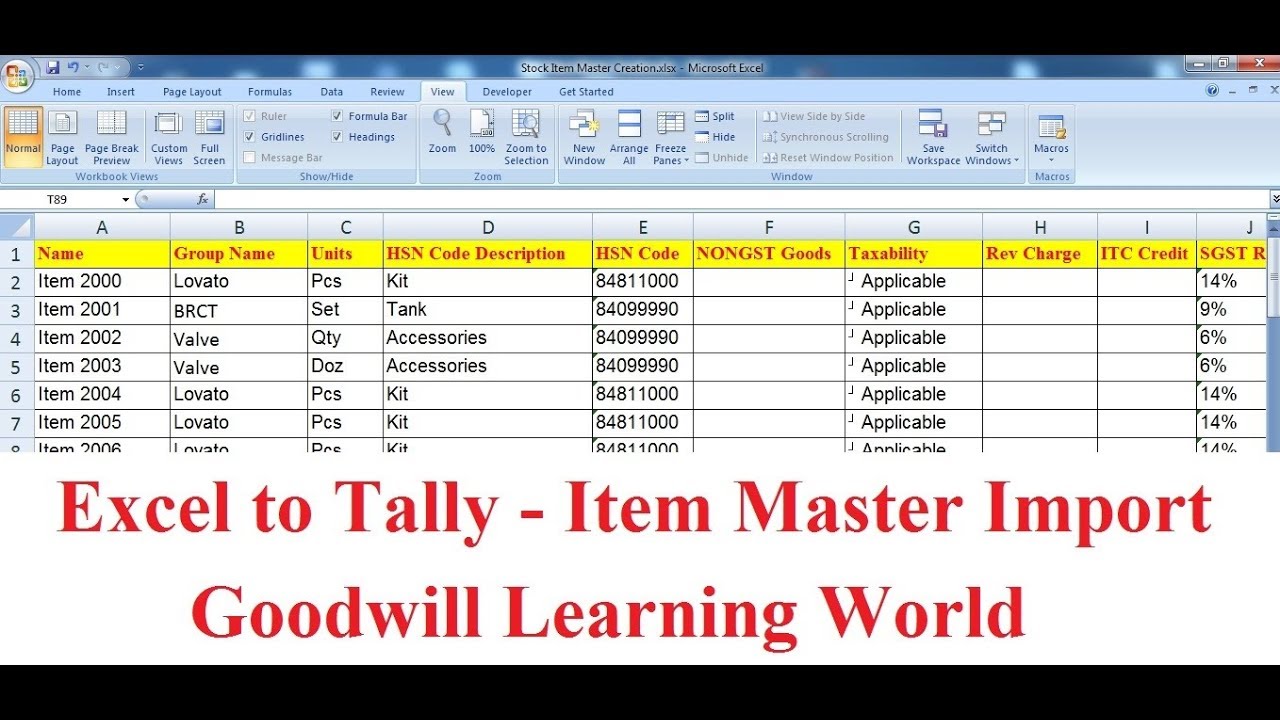

Tally Tdl For Excel To Tally Stock Item Master Import With Group And Excel The Unit Master

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Stocks Financial Calculators

Ceiling Fans Winding Data Youtube Wind Data Downloading Data Data

Financial Ratios And The Statement Of Cash Flows Mgt537 Lecture In Hindi Urdu 24 Youtube In 2022 Financial Ratio Cash Flow Statement Cash Flow

Financial Ratios And The Statement Of Cash Flows Mgt537 Lecture In Hindi Urdu 24 Youtube In 2022 Financial Ratio Cash Flow Statement Cash Flow

Financial Management Formulas Part 1 Financial Management Finance Investing Financial Accounting

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Annuity Calculator

Business Valuation Veristrat Infographic Business Valuation Business Infographic

This 1939 Stock Certificate Is From The West Virginia Pulp Paper Company Which Is Now Part Of Westrock Stock Certificates Paper Companies Stocks And Bonds

Fundamental Accounting Equation In 2022 Accounting Accounting Books Accounting And Finance

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Investing Stock Analysis

Finding Your Treasury Direct Bond On The Calculator Bond Birth Certificate Statement Template

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement